Navigating the process of transferring a timeshare can be complex, but with the right guidance, it can be managed efficiently. This article provides an in-depth look at the timeshare transfer process, covering essential steps, factors that influence the timeline, and tips for ensuring a smooth transfer.

If you’re considering selling your timeshare or purchasing one on the resale market, this guide will equip you with everything you need to know about transferring a timeshare. Let’s take a closer look.

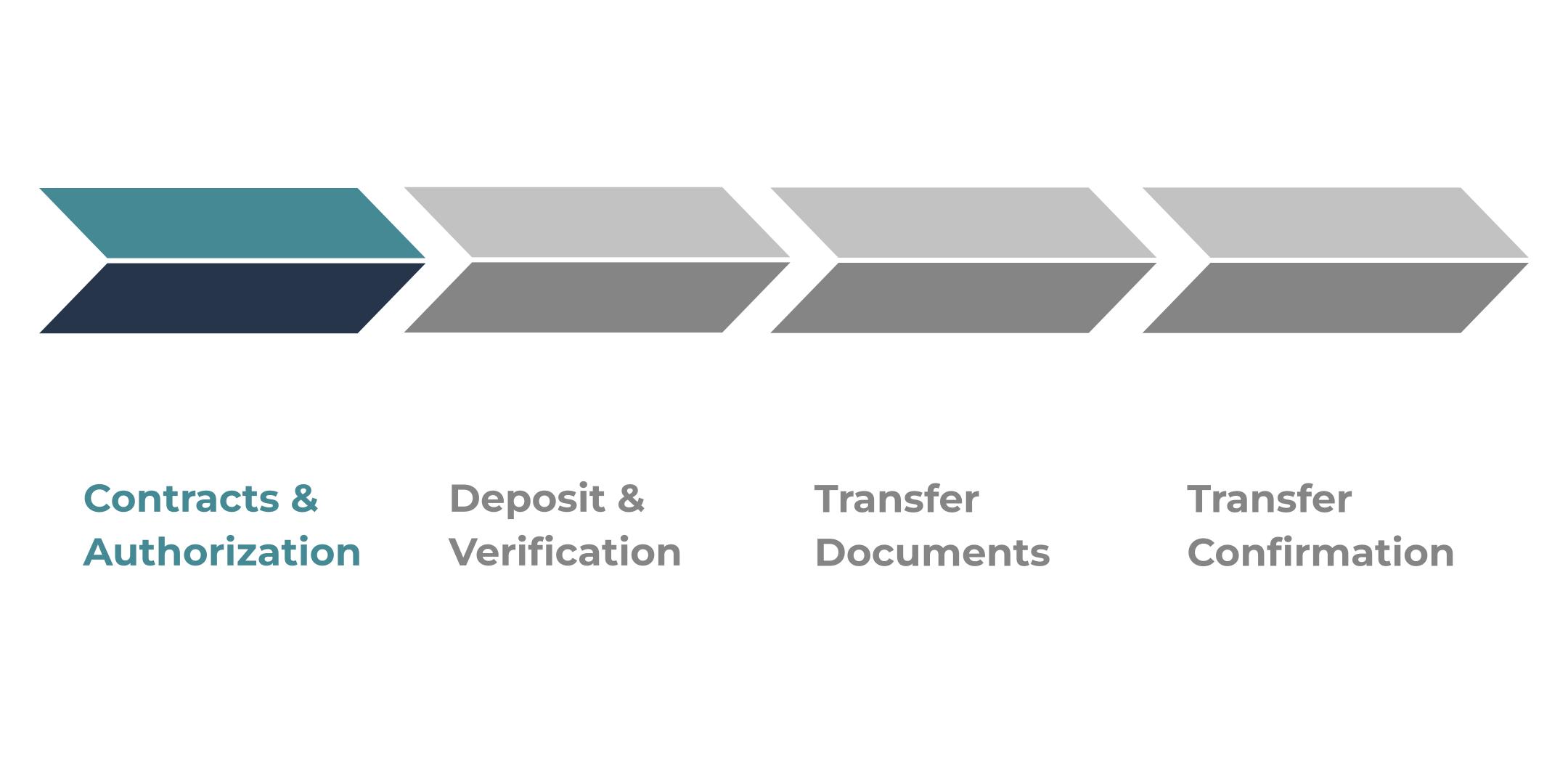

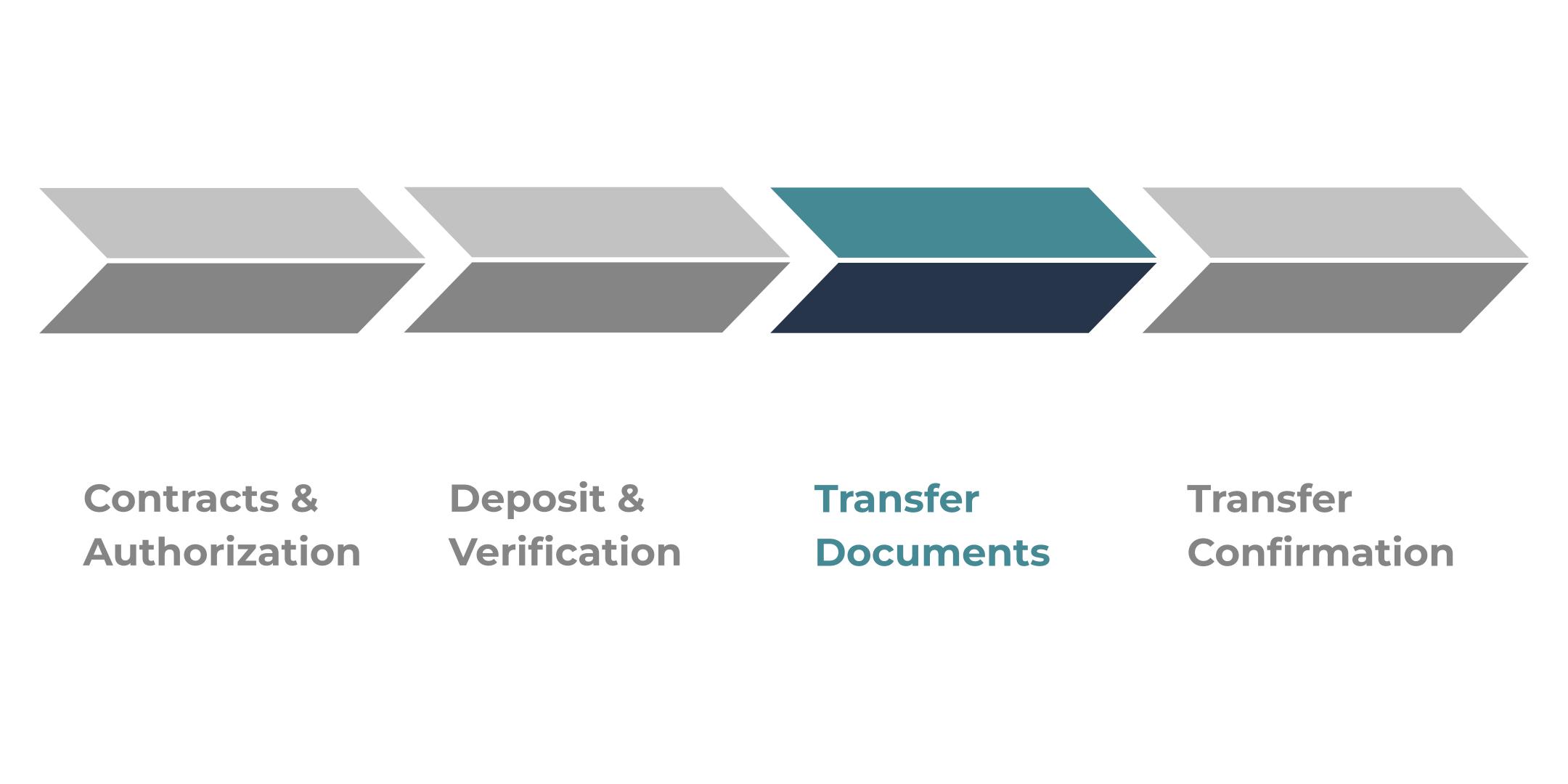

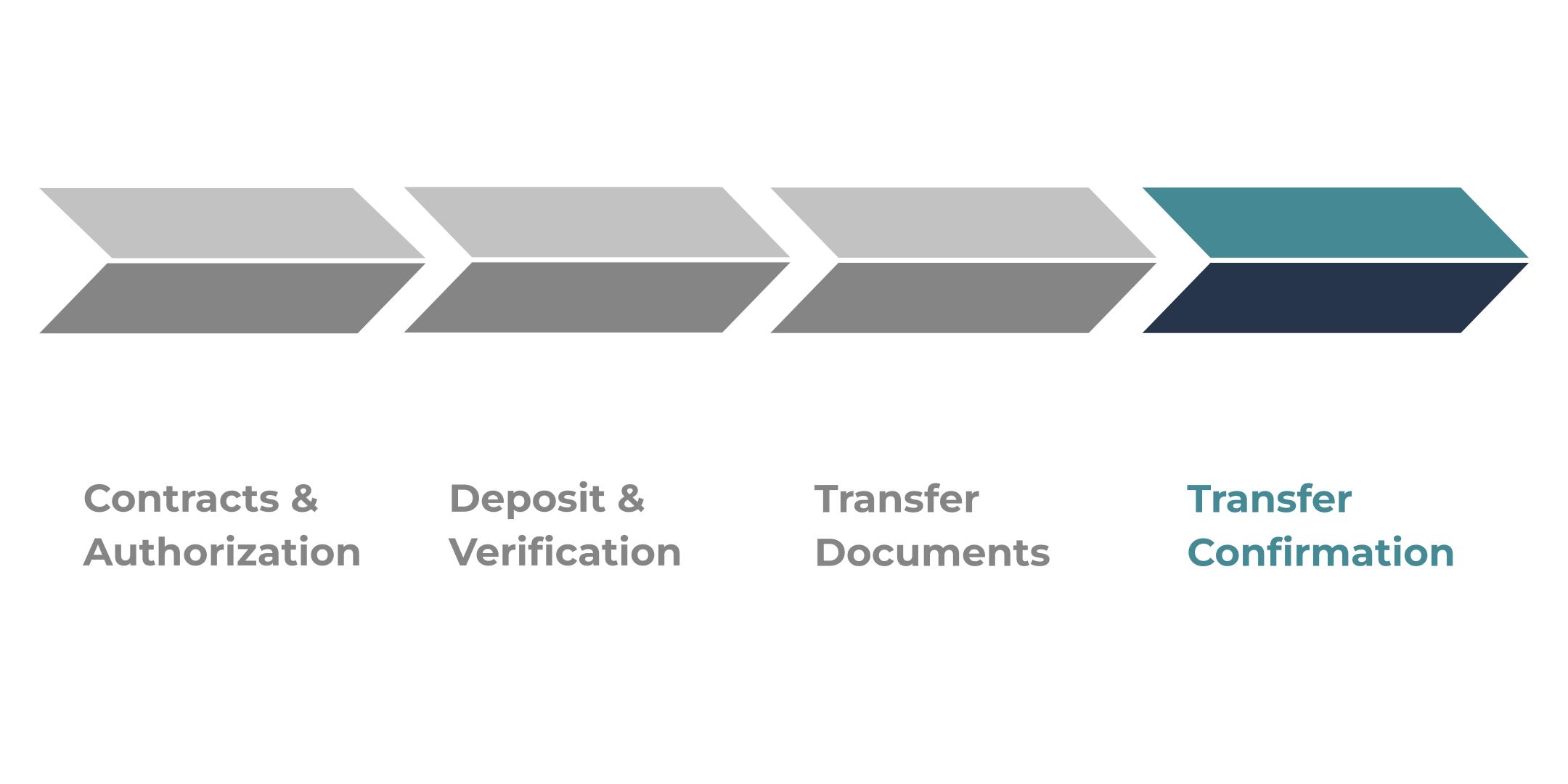

The transfer and closing process involves legal documentation, title transfers, resort approvals, and various administrative tasks. The process involved in transferring a timeshare can be broken into the following steps:

Contracts & Authorization

Preparation of Sale/Purchase Contracts and Forms for Signatures

Once the seller and buyer agree on the price and conditions for transferring the property, a purchase agreement and related documents must be prepared. Signing the sale/purchase agreement ensures all parties clearly understand the terms and conditions.

Important Note: Many developers require a signed contractual agreement from both buyers and sellers to determine whether they will exercise their right of first refusal or waive it, allowing the buyer to proceed.

The purchase agreement can be signed either with hard signatures or electronically using recognized digital signature software. The following information should be included in the agreement:

- Full names of buyers and sellers as they appear on ownership documents

- Complete details of the property, including the property name, usage rights (annual, odd, even, etc.), week or season, unit size, unit number, view (if applicable), legal description, and other pertinent identifying information

- Purchase price of the property

- Amount and deadline for the buyer to submit a deposit

- Timeline for closing the transaction

- First year of use for the buyer, including any existing reservations that may transfer from the sellers

- First year that buyers will be responsible for maintenance fees

- Payment arrangement for closing costs and transfer fees by buyers, sellers, or a split agreement

- Closing company that will hold funds in escrow and complete the transfer process

- Commission amount to a licensed broker and identifying information for payment

- Special terms and conditions such as reimbursement of maintenance fees by the buyers to the sellers or the transfer of banked points (if applicable)

Developer-Specific Authorization Forms

In addition to the purchase agreement, additional forms may need to be signed by sellers and/or buyers. For example, Marriott Vacation Club requires a specific authorization form to be signed by the seller. This form allows the release of property information to the closing company and licensed broker, verifying the details of the property and facilitating the transaction.

Sending Documents to the Closing Company

Once all parties have signed and returned the purchase agreement and any associated forms, the documents are sent to a title/closing company that specializes in timeshare closings. This company is also provided with contact information for buyers and sellers, including email addresses, physical mailing addresses, and phone numbers.

Some developers may also request copies of identification documents from buyers and sellers as part of the transfer process. It is common to submit a copy of a driver’s license or another form of identification, which the closing company will collect.

By ensuring that all necessary documents are prepared and signed, and by understanding the requirements specific to your developer, you can facilitate a smooth and efficient timeshare transfer process.

Deposit & Verification

Collection of the Buyer’s Deposit by the Closing Company

Upon receiving the necessary documents, the closing company will contact the buyers to collect the deposit required to initiate the property transfer. The deposit amount is specified in the sale/purchase agreement and will be credited towards the total purchase cost.

Requesting a Waiver for the Right of First Refusal (if applicable)

Some developers include a right of first refusal in their timeshare contracts, allowing them the option to repurchase the timeshare before it is sold to a third party. This clause gives the developer the first opportunity to buy back the timeshare at the same price offered by a prospective buyer.

For a detailed understanding of the right of first refusal, its process, and expert tips, refer to our comprehensive guides for the most popular developers:

- Marriott Right Of First Refusal: Resale Buyers & Sellers

- Hilton Grand Vacations Right Of First Refusal: Resale Buyers & Sellers

- Vistana Right Of First Refusal: Westin & Sheraton Resale

- Disney Vacation Club Right of First Refusal

When applicable, the closing company will submit a request to the developer for a waiver of this right, including the sale/purchase agreement and other relevant information. Developer responses can vary, with some providing decisions within a few days, while others may take six weeks or more. This step, when applicable, can extend the overall closing timeline.

What happens if the developer exercises their right of first refusal?

If the developer decides to exercise their right, the buyers will receive a full refund of their deposit. The sellers will then proceed to sell the property to the developer under the agreed terms and conditions. Often, we assist buyers in finding another suitable property in such cases.

The process remains similar, except that the developer becomes the new buyer. Some developers, like Breckenridge Resorts, allow the closing company to handle the paperwork transfer. In contrast, others, such as Marriott, use their own closing departments to finalize the transaction. In the latter case, sellers will receive documents directly from the resort and are advised to review these with their licensed broker to ensure accuracy and compliance with the purchase agreement terms.

Property Information Verification: Title Check, Financial and Use Estoppels

The closing company performs various actions to verify the property’s details. These checks typically include ensuring that the mortgage is paid, verifying next usage availability, maintenance fee status and amount, existing reservations, unit size, view category, season, or points, if applicable.

This information is usually obtained from the resort through a financial and usage “estoppel.” An estoppel letter confirms the ownership details and is critical for the timeshare transfer process. Most developers charge a fee to prepare this document.

For deeded properties, a title check is conducted when the buyer opts for title insurance. This check ensures there are no liens or inaccuracies in the ownership chain that could affect the buyer’s title.

Transfer Documents

Preparation of Transfer Documents by the Closing Company

Once the previous steps are completed, the closing company prepares the necessary transfer documents. These documents vary by resort and may include a deed of transfer for deeded properties, along with any county-required property transfer forms. Additionally, specific resort transfer forms might be required. For RCI ownerships, RCI transfer forms may also be prepared.

In some cases, developers will send paperwork directly to buyers and sellers for execution. When this occurs, the closing company will notify the parties to expect these documents from the resort.

Signing of Closing Documents and Final Funds Transfer

The closing company sends the transfer documents to both sellers and buyers for signatures. Typically, sellers are required to notarize the transfer documents. Although it is rare, some developers allow a verified signature, where the seller can sign in the presence of a witness without notarization. Generally, however, notarization of a deed of transfer or a certificate of ownership transfer is necessary.

Buyers will also send the final funds to the closing company upon receiving a closing statement that details the total amount due, credited for the initial deposit. Sellers receive a settlement statement outlining the expected proceeds after closing.

Our licensed brokers review all closing documents for accuracy before sending them to buyers and sellers, ensuring that all terms comply with the purchase agreement and that both parties are protected.

Recording of the Deed for Deeded Properties

For deeded properties, the closing company will send the deed to the appropriate county recorder’s office for recording. This process can take from a few days to several months, depending on the county’s processing times.

Submission of Transfer Documents to the Developer/Resort

After the deed is recorded (if applicable), the closing company sends the complete transfer package to the developer/resort. This package includes the notarized deed, any required resort transfer forms, and any transfer fees payable to the developer/resort.

The file then sits with the developer/resort for the transfer process, which typically takes three to six weeks. However, some developers may take several months to process and confirm the transfer completion.

Transfer Confirmation

Receipt of Transfer Confirmation

The developer/resort will send a transfer confirmation to the closing company. The closing company will then notify the seller, buyer, and broker that the transfer has been completed. At this stage, the buyer can call the resort to verify ownership information and set up an online account for accessing ownership details if applicable. Some resorts also send a welcome packet with information directly to the new owner, and may send the seller a transfer confirmation as well.

Disbursement of Funds and Final Closing Statements

After the transaction is finalized, the seller will receive funds from escrow along with any applicable final closing statements.

Request for Feedback

Finally, A Timeshare Broker can request feedback from sellers and buyers to ensure the closing process met their expectations in terms of customer service. We continually strive to improve communication throughout the closing process to facilitate smooth and fast transactions. Customer satisfaction and repeat business referrals are paramount to us, making your feedback a crucial part of refining our transfer process.

Factors Affecting Transfer Time

- Method of Transfer: Using a broker to buy or sell can facilitate a smooth transfer process by streamlining paperwork and handling communication.

- Response Time: The speed at which both buyer and seller review, sign, and return documents significantly impacts the overall timeline. Delays from either party can extend the process.

- Resort Approval: Some resorts require additional paperwork and approval processes for ownership transfers, which can add extra time to the transfer process.

- Deed Recording: Registering the transfer with the relevant county office can take from a few days to several weeks, depending on that county’s turnaround time.

Tips for a Quick & Seamless Transfer Process

- Choose an experienced broker: Their expertise can expedite the process and navigate any potential complications. A Timeshare Broker has over 20 years of experience in the timeshare resale industry, with a stellar track record of helping clients achieve seamless transfers.

- Respond promptly to requests: Delays on your end can significantly impact the timeline.

- Stay organized: Keep all documents and paperwork well-organized for easy access.

- Ask questions: Don’t hesitate to reach out to your broker if you have any questions or concerns.

We hope this information helps clarify the timeline for transferring a timeshare and how long closing might take. Please remember that any specific timeframes mentioned are general guidelines. For a more accurate timeframe and guidance tailored to your situation, consult with a knowledgable timeshare broker.

As always, feel free to fill out a contact form for a free consultation with one of our licensed real estate agents. Our team of timeshare experts is ready to answer any remaining questions regarding timeshare resale or the transfer process on the resale market.